Better decision-making begins with objective, reliable assurance services.

Our professionals take an unbiased, comprehensive look at the health of your organization, providing you with a clearer picture of where your business stands today and your awaiting opportunities.

What are your numbers trying to tell you?

Your organization’s financial statements, projections and valuation are key pieces of business intelligence, but if you’re unable to interpret each element in its full context, you’re missing out on the full story. From meticulous financial statement audits to independent reviews and compilations, our proven assurance services combine deep expertise with cutting-edge technology to deliver evidence-based insight into your financial situation.

We’re on a mission to protect your organization against costly oversights. Our exhaustive M&A solutions include meticulous due diligence, full-scope administrative support and trustworthy guidance during every phase of your transition, from evaluating potential acquisitions through to post-merger requirements.

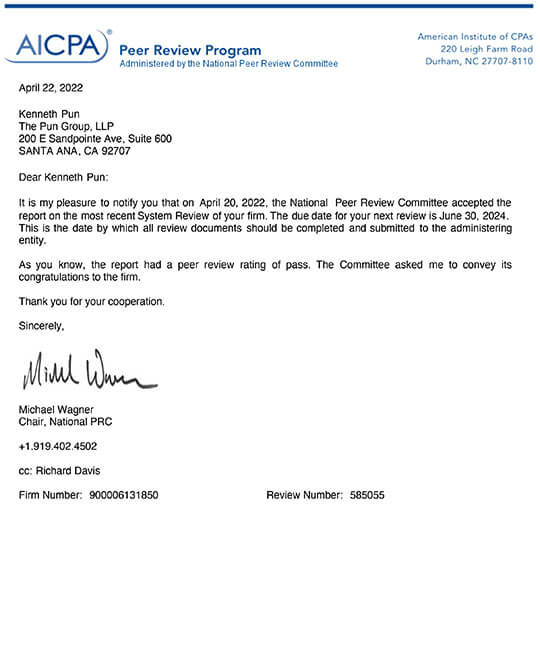

As a Public Company Accounting Oversight Board (PCAOB)-registered firm and active members of AICPA the Governmental Audit Quality Center (GAQC) and the Employee Benefit Plan Audit Quality Center (EBPAQC), we ensure your hiring, reporting and other business practices are operating in full compliance.

Wherever your business is going, we’ll make sure you get there safely.

Download

AI Auditor Fact Sheet

Comprehensive assurance services from an experienced team.

Public and private companies, nonprofit organizations and governmental agencies trust our seasoned business advisors to provide an objective assessment and supporting evidence of their financial condition.

- FINANCIAL STATEMENT AUDITS

- REVIEWS AND COMPILATIONS

- DATA COMPILATIONS

- DUE DILIGENCE

- FINANCIAL FORECASTS AND PROJECTIONS REPORTING

- PRO FORMA FINANCIAL INFORMATION REPORTING

- COMPLIANCE ATTESTATION

- AGREED-UPON PROCEDURES ENGAGEMENTS

- INTERNAL FINANCIAL CONTROLS REPORTING

- EMPLOYEE BENEFITS PLANS (ERISA) AUDITS

Download

The Pun Group Peer Review Report

Customized Solutions for Your Industry

Don’t settle for a “one-size-fits-all" approach. Our experienced CPAs and business advisors will show you how to take advantage of every opportunity to strengthen your financial foundation.Get to know your new accounting allies.

“The Pun Group’s most valuable asset is our reputation, and that drives our every interaction with clients.”

John (Jack) F. Georger, Jr.

Partner

Years with The Pun Group: 12

“The Pun Group’s most valuable asset is our reputation, and that drives our every interaction with clients.”

Andrew Roth

Partner

Years with The Pun Group: 10

“The Pun Group’s most valuable asset is our reputation, and that drives our every interaction with clients.”

Isabela Lopes

Chief Operating Officer

Years with The Pun Group: 10

Let’s get to work.

We’re here to help every step of the way. Contact us today to discuss how our personalized attention and industry-specific solutions help you maximize your potential.